The ed-tech boom in India — A marketing perspective

[ ]OSINT journalism on India’s top ed-tech startups — Byju’s, Unacademy, Toppr, Vedantu, and WhiteHat Jr.(Of course, I can write headlines as cringey as some of their ad copies. Don’t worry, I have enough examples below to make your day)

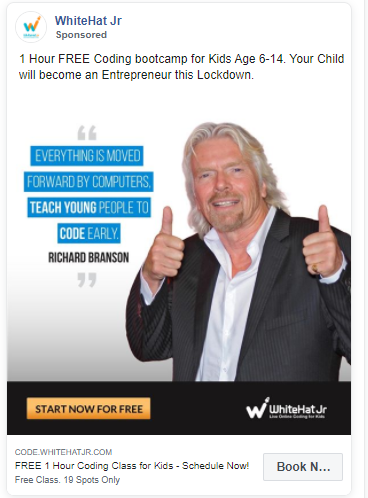

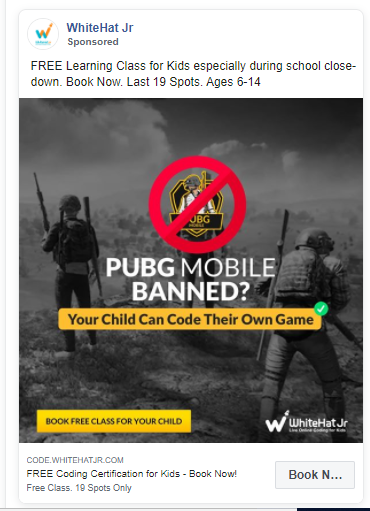

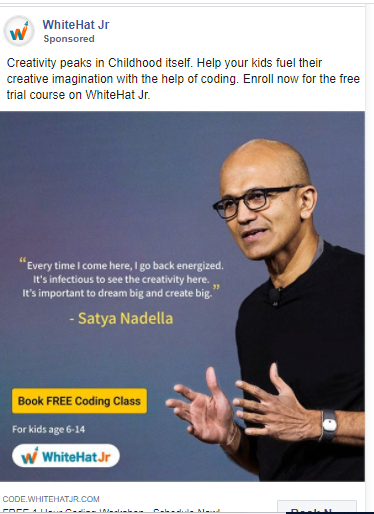

India’s ed-tech market is getting hot. Indian parents have always been paranoid, but the pandemic has acted as an extreme catalyst. Every parent wants his/her kid to be the next Elon Musk or ‘the guy who created Whatsapp’. With schools shut and US tech companies growing 3–5x in a span of 3 months, the parents have deduced that learning how to code is the answer to life, not 42. Karan Bajaj’s two-year-old start-up Whitehat Jr has been acquired by Byju’s in a $300Mn all-cash deal. Unacademy received $150mn in a fresh funding round that pegs the startup’s value at $1.45bn. Byju’s has been eyeing the overseas market and has acquired US-based Osmo, a maker of educational games for $120 million. The sector looks hot. There has been a bit of chatter about how some of these startups ‘scam’ our paranoid parents into buying a year-long course for their kid. Byju’s has especially been (in)famous about their aggressive sales team. Recently, WhiteHat Jr’s ads that seem to skirt the border of illegal content usage (using Satya Nadella’s image on their ad?) and definitely lie within the grounds of ultra-cringe, have started a few conversations about the morality of it all. Do we really need kids to learn coding at 6? Indian parents are known to dump their unfulfilled dreams onto their kids’ shoulders and sometimes, this culture act drives some of these helpless kids to suicide… Sorry, I’ve completely digressed. This post aims to use available free spy sources and understand some of the marketing tactics employed by these companies. If you want to be an online ninja spy too, read my amazing post here.

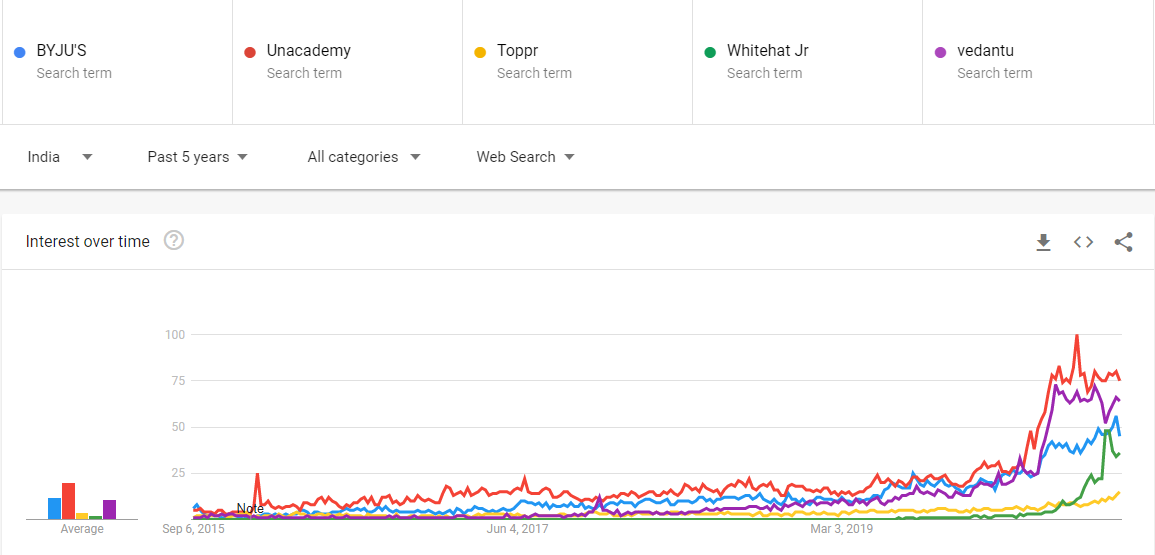

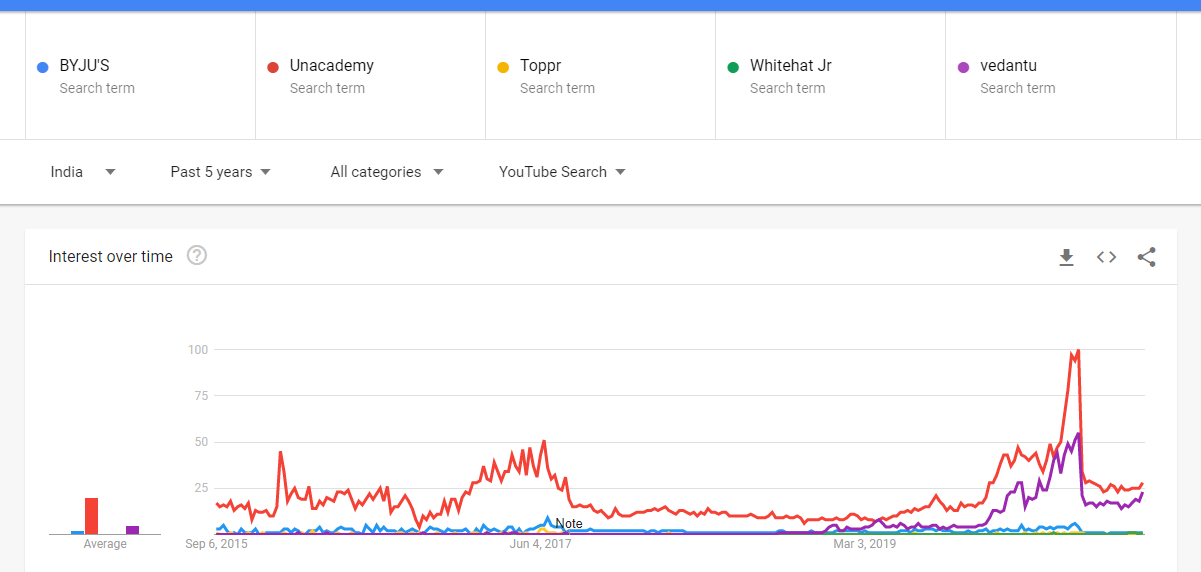

The first thing I want to look at is the relative popularity of these companies from Google’s organic search perspective. I use the company name as the search term and try to understand their relative popularity. Please keep in mind that this is by no means reflective of the real market share of these companies — almost all of them employ paid traffic tactics and buy audiences from Google Search, Display, and Facebook. The idea here is to check something simple, like the share of voice maybe?

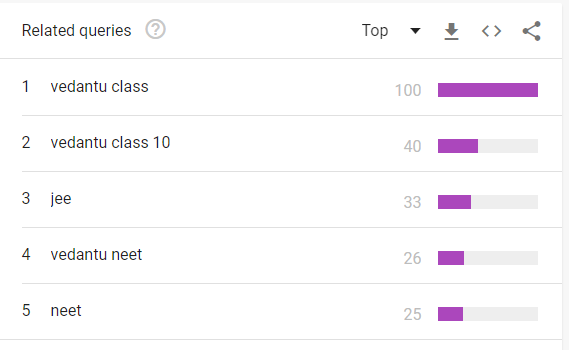

Fascinating, right? CoVid has accelerated the discovery of the startups’ services by a couple of years for sure and probably saved them quite a lot of marketing dollars. It’s also interesting how WhiteHat Jr seems to have taken some share from Vedantu. That sounds plausible — Vedantu also offers Coding For Kid, which is WhiteHat Jr’s primary offering. Unacademy appears to have the highest organic search — not surprising since they started as a YouTube channel. Google Trends also offers cooler charts for us to dig through each search term’s specifics.

Ok, I love this chart — it looks like Byju’s has a stronghold in South India and Unacademy has established its base in North and Central India. To understand why such a pattern exists, we may need to understand what their core offering is.. or just look at Turtle Tutorial’s comparison of their services vs Unacademy and Byju’s. Wow, do parents fall for this? Anyway, Byju’s focus is on math and science, for school students from class 1 to 12, and also for competitive exams like IIT, NEET, CAT, and IAS (most of them have a heavy focus on math and science). Unacademy’s focus is on civil services, bank jobs, railway exams, etc. Northern states see a lot many candidates for UPSC (Unacademy’s prime focus); I guess that’s one of the reasons why we’re seeing this trend.

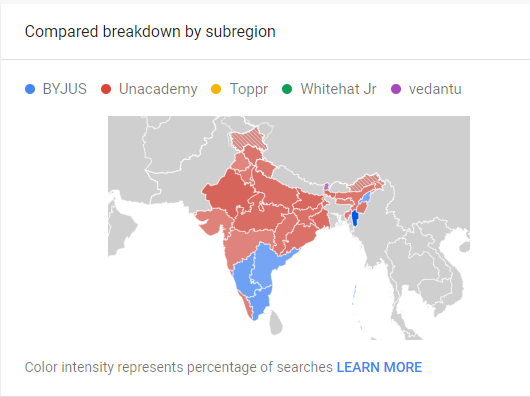

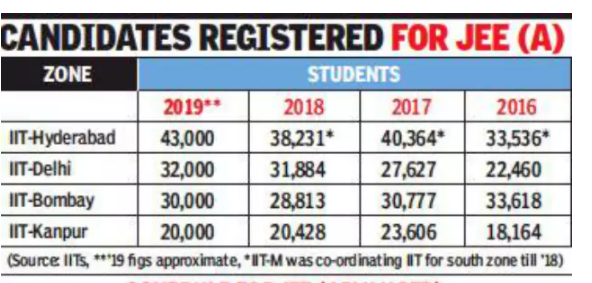

Similarly, we see a lot of IIT aspirants from the southern states (aspirants, and not students. Northern states still dominate IIT seats). Byju’s has also established some kind of a partnership program with CBSE schools in the south.

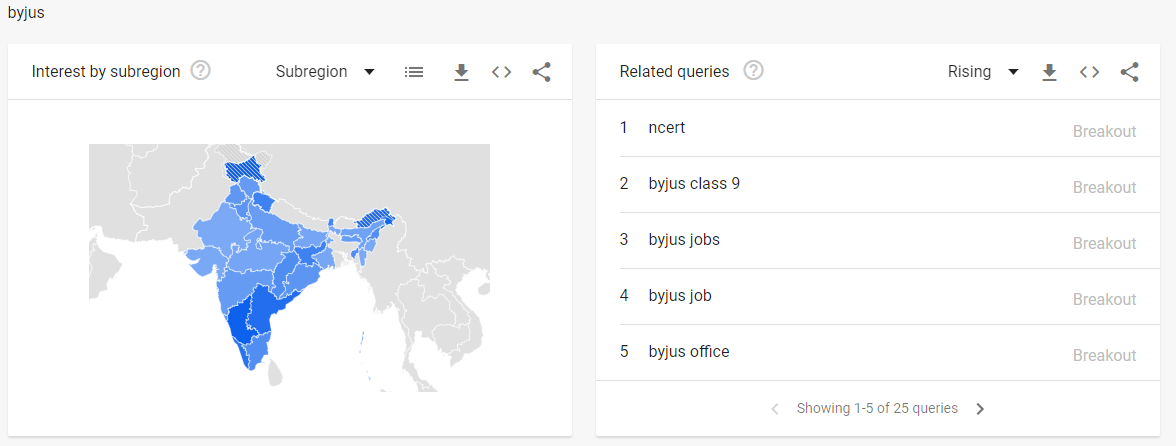

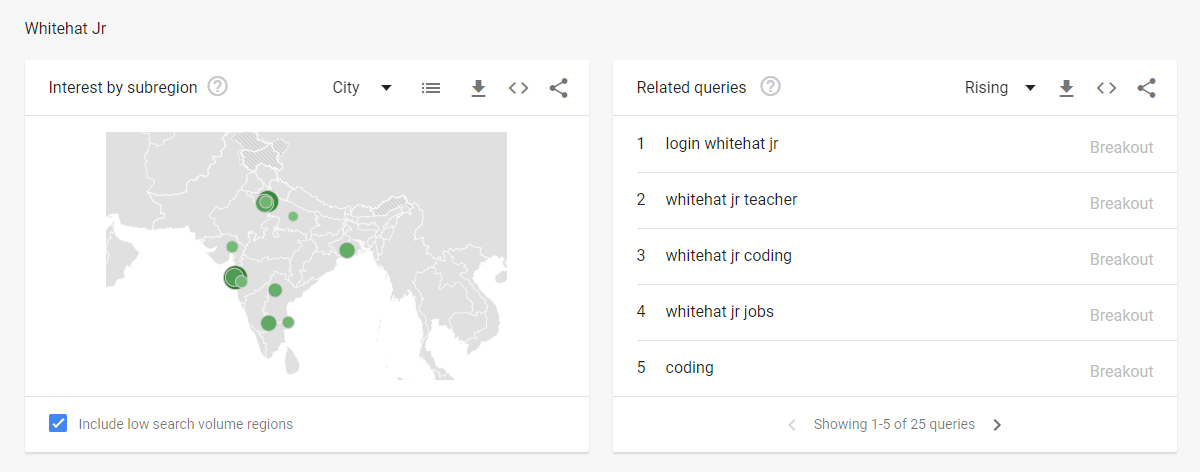

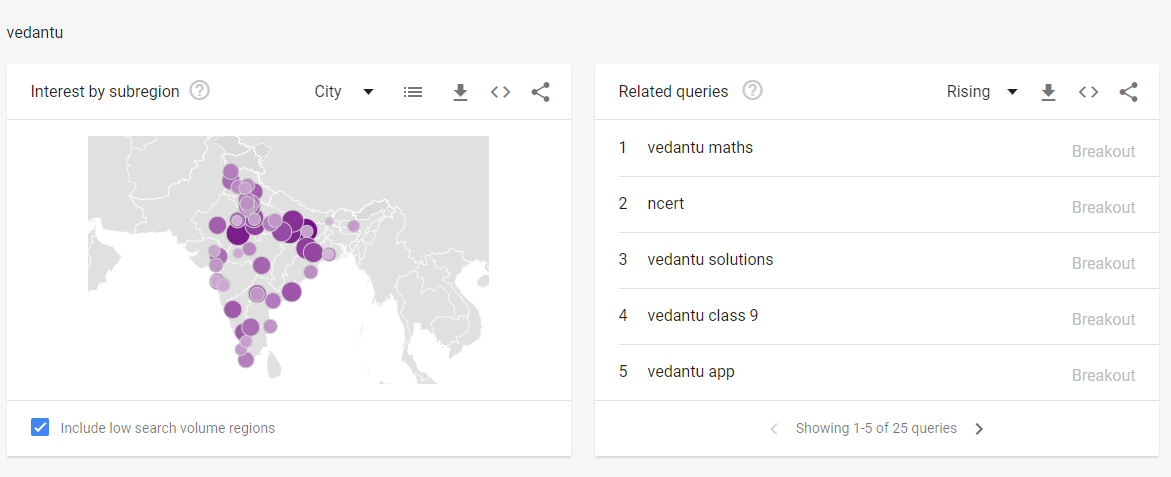

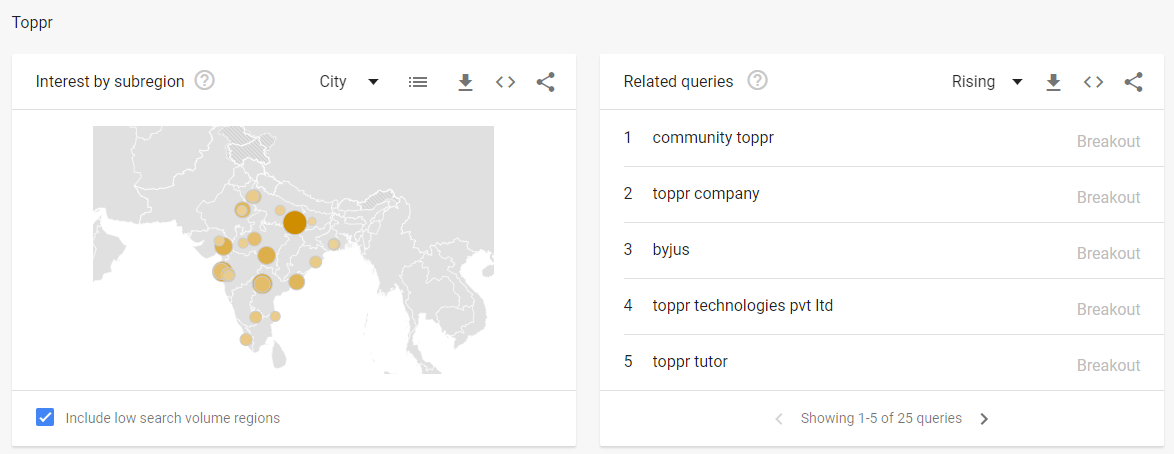

In the above table, IIT-Hyderabad refers to the southern zone states, IIT-Bombay refers to aspirants from Maharashtra, Gujarat, Karnataka, and Goa. Below are the heatmaps for each of the companies’ search traffic data along with a list of popular queries:

Up till now, we were looking at these charts with data from the web search. However, for a few of these startups, especially Unacademy, Youtube search is the largest source of traffic.

Vedantu seems to be playing a game of catch-up. WhiteHat Jr has probably not focused too much on this front — there are enough coding videos on Youtube and it might be difficult to get noticed organically.

On Youtube Search, Vendatu is focused on Indian school-specific keywords that might be easier to rank for. A similar strategy seems to be followed by Unacademy as well:

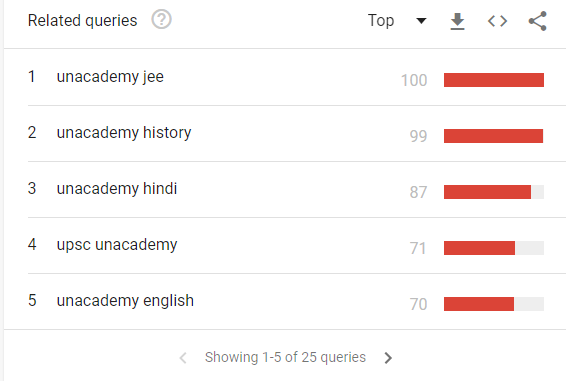

Next, I wanted to look at Byju’s paid and organic numbers (all estimates, of course) and the keywords they are spending most on (I’m assuming that keywords on which more money is spent = keywords which convert better)

This is a snip from SemRush. SemRush tracks organic and paid keywords on Google and tries to paint a picture of their corresponding volume and spends. Byju’s authority score is high and therefore allows them to get a steady stream of organic traffic from SEO. The 1.5M backlinks have strongly contributed to this authority score (DA = Domain Authority). Organic traffic is the highest for Byju’s, as is their bounce rate. I took a look at their top 10 paid keywords (highest amount spent to lowest) :

- byjus

- aakash institute

- meritnation

- learn byjus com

- byju’s app

- online classes

- gmat prep

- unacademy neet

- 6th class

- byju’s learning app

Byju’s is focused on CBSE students and we can see that trend from Google Trends (ncert) and here in the paid keywords where they’re aggressively bidding against two competitors in the same space: Aakash institute and Meritnation. They’re also trying to capture some share from Unacademy for NEET.

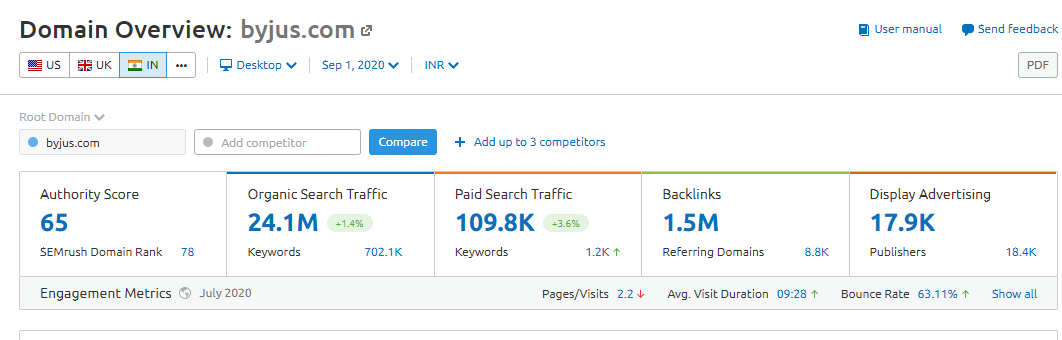

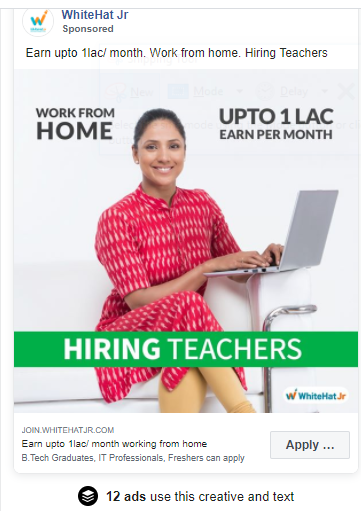

Another interesting entrant is WhiteHat Jr. They are only two years old and are focused on coding for kids. They have invested a LOT in paid marketing, both on Facebook and on Google, but for different reasons. Since WhiteHat offers 1:1 coding classes for kids, they need to maintain adequate supply as they scale up on user acquisition.

Their top 10 keywords by cost are:

- work from home

- google jobs in india

- work from home india

- work from home ideas

- google jobs

- home to work

- google form filling jobs

- whitehat jr

- job in google company for fresher

- how to get job in google

I am not exactly sure what’s going on, but I guess that they are trying to recruit teachers? ‘Coz in no sane world can I imagine this being an ad to entice parents for getting their kids to learn to code.

I look at their Facebook ads and now it makes sense. They are using the same copy ‘Work from home’ to recruit teachers. Although I am not too sure how effective such a vague statement is? Maybe they use some targeting when it comes to their FB ads.

They have determined that user acquisition (in this case, paranoid parents) is best done through Facebook, Instagram, and Display ads. In any case, I also see that WhiteHat is the only company to use Taboola and Outbrain (yes, those spammy ads below Times of India website articles) for user acquisition. Again, the hypothesis probably is that PP (paranoid parents) do tend to read and click on.

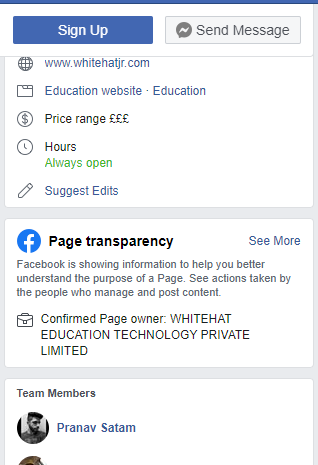

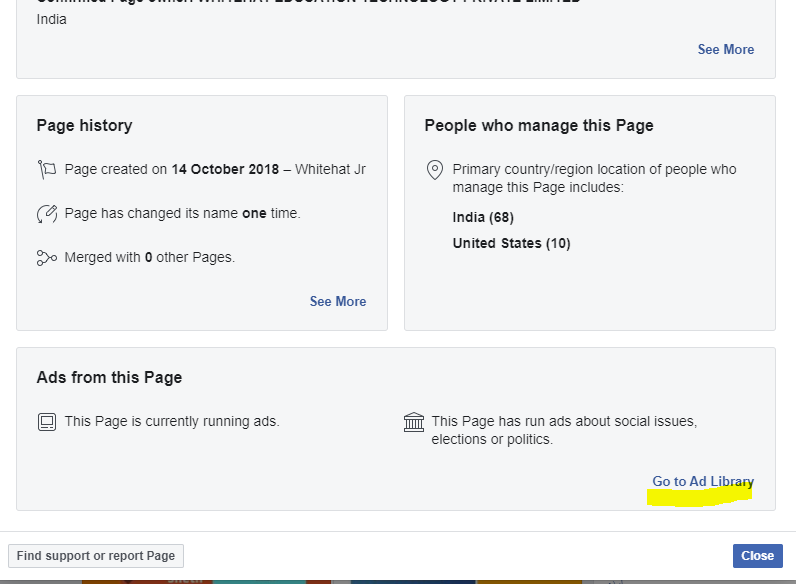

Now we come to my favorite part of this exercise: looking at all the creepy little Facebook ads. How do I find them? Simple. You can see every Facebook page’s active or inactive ads by checking out their ‘Page Transparency’ section.

Once you click on ‘See More’, a dialog box opens up and you need to scroll down and click on ‘Go To Ad Library’ to check out all their ads sorted by date!! You can see when the ad was launched, which platforms is it running on, the creative used as well as the URL. Neat.

There are always 19 spots left. For quite some time now. LOL. The rest of the companies seemed reasonable and rational with their ads, until now. Toppr is of course taking a leaf out of WHJ’s page and is fantasizing about the day their coding course enables a kid to detect genomes of viruses.

The reason I went down the ad rabbit hole for these companies is that it’s apparent that they are all heavily dependent on performance marketing for growth. With a fresh infusion of funds and considerable competition, each company is intent on trying aggressive push tactics, even if they may be expensive.